Saving for College in Kansas City: Missouri vs. Kansas 529 Plans

The 529 Plan, a college savings plan named after the section of the IRS code that created it, is a state-sponsored investment program used to save and invest for qualified education expenses.

The IRS, as well as most states, offer favorable tax rules and incentives to make it easier to save. Luckily for Kansas Citians on both sides of the state line, Missouri and Kansas each offer a tax deduction for contributions to 529 accounts, but the rules are a little different depending on where you live.

Why Use a 529 Plan At All?

According to the US Bureau of Labor Statistics, college tuition and fees have increased by an average of almost 5% annually between 2000 - 2020, compared to a general inflation rate closer to 2% for other goods and services.

The chart below shows the current estimated in-state tuition and fees at a few local public universities. Compare that to the same annual costs inflated at 5% annually for 18 years. Finally, the last column shows the total expected tuition and fees for 4 years of undergraduate education for a child born in 2021 .

It’s no small thing to plan and save for education, and these numbers are for just one child and without adding room and board! To pick on my alma mater, the University of Missouri, if we assume a 6% average annual rate of return, it would take contributing $274 every month ($3,288/yr) from a child’s birth through college graduation to fully cover the $130,925 above.

The chart above displays the importance of starting early, as the compounding growth really takes off in the second half. But as I like to say, the best time to start may have been yesterday, but the next best time is today.

It’s important just to get started. It’s also okay to start small, and even if you don’t fully fund the entire goal, using a 529 to help save what you can is still beneficial.

Using a 529 Plan can help in two big ways. First, Missouri and Kansas each offer a deduction from State income taxes for contributions to a 529, and the tax savings can help to offset the contribution. Second, distributions from the account are tax-free at the Federal and State level when used for qualified education expenses.

However, it’s also important to note that if withdrawn for other purposes, the growth is subject to income tax plus an additional 10% penalty. Make sure money you put into a 529 is intended for education purposes.

There are of course reasons not to use a 529, and situations where there may be better strategies based on an individual’s circumstances. It can be helpful to talk to a financial planner to help answer these questions.

529 Tax Deductions Differ Per State

Kansas City is unique because we are one city in two states. Entire extended families may live in KC, but be split by the state line. It’s important to know the rules for both Missouri and Kansas in case a grandparent or family member wants to make a contribution for a child across state lines. The contributor’s home state is what matters.

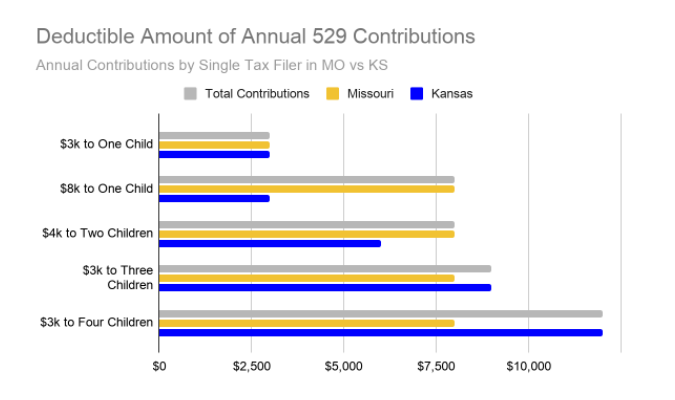

Missouri residents can deduct up to a maximum of $8,000 ($16,000 for married couples filing a joint tax return) of total contributions made across ALL 529 accounts for ALL children / beneficiaries.

However in Kansas, residents can deduct up to a maximum of $3,000 ($6,000 for married couples filing a joint tax return) for EACH child / beneficiary.

Note: You can contribute more than the “deductible” amount allowed by your state, you just won’t receive a tax deduction for that excess contribution. However, be sure that you remain under the annual gift tax exclusion of $15,000 if you don’t want file a gift tax return and dip into your unified tax credit.

Clearly, Missouri residents have an advantage when giving larger amounts to fewer beneficiaries. An $8k contribution to one child would be fully deductible in Missouri, but limited to just $3k in Kansas.

However, Kansans have a big advantage in giving smaller amounts to a larger number of beneficiaries. A Kansan could contribute $3k each to 4 children (or more!) and deduct all $12k, whereas a Missourian would be limited to deducting just $8k.

Most states require residents to use their own state’s plan to qualify for the tax benefits, but both Missouri and Kansas allow residents to enjoy their home-state tax deductions regardless of what state’s plan is used.

This is good news for Kansas City grandparents who may want to contribute to a grandchild’s existing plan in another state!

529 Plan Investments & Contributions

Making, and investing, contributions to a 529 is one area where Missouri and Kansas are similar.

Each offers similar broad-based, low-cost investment options. Both offer a lineup of age-based portfolios that start out invested more aggressively when the child is younger, and then gets more conservative and takes less risk as the child gets older and closer to using the funds.

Both state’s also offer investment options that aren't age-based. These target an assumed level of risk and return and allow you to choose your own path.

Both plans have a user-friendly website and a clean easy-to-use interface. You can open an account online and make one-time contributions, or set up automatic recurring contributions from your bank account.

Find out more about the Missouri MOST 529 Plan and the Kansas LearningQuest 529 Plan on their individual websites.

Conclusion

College funding is an important financial goal for many families, and it’s likely to be the second or third largest financial objective after retirement and homeownership for those families.

A 529 account can be a powerful tool in your toolbox allowing potentially decades’ worth of contributions and growth to be distributed tax-free for education! But there is nuance between different state rules that’s important to understand.

Whether you’re a family with many kids, or a grandparent with many grandchildren, a little planning goes a long way.