How to Receive the KCMO Earnings Tax Refund

Ah, the KCMO 1% “Earnings Tax.” It is a topic of frequent debate and ultimately an indelible mainstay for those who live and/or work within the city. If you have recently moved to Kansas City or received a “surprise!” letter in the mail, you may be wondering about this tax you could be obligated to pay.

But did you know that you can get a refund if you overpaid through your payroll withholding? During the work-from-home year of 2020, many people will be owed this refund and may not even be aware of it! Because if you are a DIY tax preparer, you could be skipping the tax form that will allow you to get a refund from the city.

In this article, I’m going to show you how to find out if you qualify for a refund and where to file to receive it.

What is the KCMO Earnings Tax?

Before we get into your tax return, let’s look at the city’s own language on the KCMO Earnings Tax:

“The earnings tax (sometimes referred to as “e-tax”) is a 1 percent tax on an individual’s earned income such as salaries, wages, commissions, tips and other compensation. It generates revenue that pays for a wide variety of city services used by all those who live and work in Kansas City, Missouri.”

The city’s website goes on to describe who is obligated to pay:

“All Kansas City, Missouri, residents are required to pay the earnings tax, even if they work outside the city. Nonresidents are required to pay the earnings tax on income earned within Kansas City, Missouri, city limits. The tax also applies to the net profits of businesses.”

To reiterate, here is Ollie Bockwinkel, a tax accountant at Pro 31 Tax & Accounting LLC who serves entrepreneurs in the Kansas City metro area:

“Whether your employer's payroll department is tracking your daily work location or not (kudos to the ones that are providing detailed reports making exact calculations based on the 260-day year,) it is your responsibility to pay the KC 1% tax. If you live in KC and they withheld nothing, you are liable. If they withheld the tax and one or more of the exceptions applies to you, calculating the difference, ultimately, is up to you.”

Perhaps you are reading this and coming to the realization that you could stand to hire a professional tax preparer this year. We have all been there!

If so, let this be your encouragement to begin a long-term relationship this tax season with someone like Ollie, who you can connect with on LinkedIn.

Who gets a refund on the KCMO Earnings Tax?

Here’s the thing about the earnings tax that some people miss. Many of us travel for work, have a remote office, or move residences. The implication of this is that there are times throughout the work year where you may not have lived OR worked inside of the limits of the city. Those may be reasons to ask the city to return money back to you if you have overpaid.

Let’s look at an example:

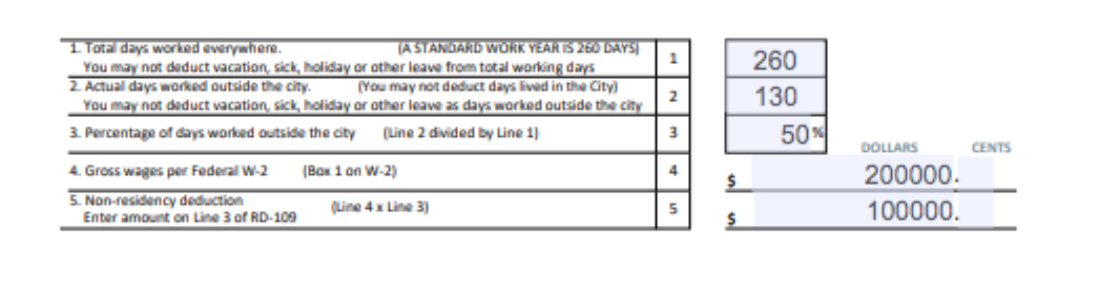

Marty McFly has an office in Kansas City, MO but lives in Lees Summit and has earned income of $200k during 2020. Marty traveled for work outside of the city 130 out of the 260 during the year, or 50% of work days. According to the city, Marty is only required to pay his 1% earnings tax on those days worked in Kansas City. Since 50% of $200k is $100k, and 1% of $100k is $1,000, $1,000 is the tax owed.

Therefore, although Marty had $2,000 withheld by his employer, he only pays $1,000. He gets his $1,000 back by filing for a refund from the city.

To further help visualize this, I made a nifty flow chart to quickly help you find out if this refund applies to you:

Now do you see why working from home in 2020 may have allowed so many to receive this refund?

In fact, so many people will be paying lower Earnings Taxes this year that the city government is concerned about what the decreased revenue will mean for their own financial situation.

After all, about half of the people who pay the tax reside outside of the boundaries of KCMO. Surely, many of these workers stayed at home for a significant portion of 2020. This is not even to mention the fact that many workers were also out of work in 2020 in the first place!

Needless to say, all of this is not great for tax revenue. Furthermore, it seems evident that working from home is going to continue to become more common, even with COVID-19 on the decline. Sounds like a great lesson for all of us, families and governments alike, to shore up our financial house in anticipation of “black swan” events!

My commentary aside, we can all follow the tax rules that are written to receive the refund we are owed.

Filing for your refund

Fortunately, the city makes it really easy to get a refund if you follow their steps and have proper documentation. The first step is to visit the city’s Finance Department’s site, which is linked here.

Next, you will need to calculate the percentage of days throughout your work year that you either lived or worked outside of the city. Here is an example of the worksheet on Form RD-109, which can be found here:

(numbers have been added for illustration purposes)

It is important to point out that you may be asked to provide documentation to account for these days that you lived or worked outside of the city. Vacation days, unfortunately, do not count.

Here is Ollie Bockwinkel again:

“One question I have seen is, "Can I count my vacation time as non-resident days?" Unfortunately not. Regardless of whether your time off was at home in Shawnee or at the beach in Naples, vacation/sick leave/PTO days are allocated to KCMO if that's where your workplace is. “

Now you are ready to file your return. As I pointed out earlier, you will not be able to file using Quicken or TurboTax. Instead, you can file online by using the city’s Quick Tax site.

After you have filed, you wait to receive your refund. Personally, I have found that the city processes these returns in a timely manner.

Conclusion

And you’ve done it! You have received your KCMO Earnings Tax Refund. Still have more questions? Luckily, the city does have a long FAQ section that goes much deeper than this article.

If you benefit at all from this “tax hack” this year, please shoot me a line at my company website. It always makes me smile to save someone a few dollars of their hard-earned money on taxes.